San Bernardino Apartment Broker

Apartment and Commercial Real Estate Investors in San Diego demand will outstrip the supply of marketed apartment and commercial real estate properties this year. Class C assets in these areas will steady in the mid-7 percent range and demand for top-tier apartment properties to the mid-6 percent range.

2011 Market Outlook

· 2011 NAI Rank: 6, Down 4 Places. San Diego will retain a top 10 ranking in the NAI.

· Employment Forecast: A 1.9% increase.

· Vacancy Forecast: 3.6%

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Orange County apartment investment sales will outpace other major California markets for the second consecutive year, fueling considerable occupancy gains as completions slip to historic lows.

2011 Market Outlook

· 2011 NAI Rank: 5, Up 2 Places: Orange County claimed the highest position among Southern California apartment markets due to healthy employment projections and very low home affordability.

· Employment Forecast: In 2011, a 2.6% gain.

· Vacancy Forecast: 4.4% in line with the 10-year average.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Los Angeles County apartment market will gain traction as rehiring efforts boost rental household formation and completions. Los Angeles Apartment Sales will pick up.

Cap rates were pushed down for Class A and well-located Class B product to 6-percent range. Cap rates for assets with some level of distress and located in perimeter areas will average above 7 percent in the early part of 2011.

2011 Market Outlook

· 2011 NAI Rank: 11, Up 2 Places. Los Angeles into the top 10 apartment market.

· Employment Forecast: 1.5% gain.

· Vacancy Forecast: 4.4 % this year.

· Rent Forecast: Rents will advance 2.7%.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Inland Empire apartment operations will strengthen in 2011 as payroll expansion resumes and the pace of new construction remains constrained. Job gains will become a primary driver of renter demand growth. Total employment will post net gains for the first time since 2006, and occupancies will continue to rise, led by strong absorption.

Apartment Investment activity in the region will continue to improve in 2011 as long-term hold buyers purchase bank-owned assets. Opportunities to acquire REO listings and value-add properties will remain prevalent. Cap rates for these assets will average in the mid-7 percent to low-8 percent range this year. Demand for assets closer to Los Angeles County employment centers will outstrip supply.

2011 Market Outlook

· 2011 National Rank: 32, Up 5 Places. Inland Empire kept the market in the bottom 1/3 of the ranking.

· Employment Forecast: Total employment in the two-county region will expand by 1.5%.

· Vacancy Forecast: Average vacancy rate will fall approximately 100 basis points this year to 7%.

· Rent Forecast: Effective rents will increase 2.2%.

· Investment Forecast: Although REO and top-tier deals will dominate sales this year, some unique opportunities will emerge.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

By Stephen H. Scholder

Although investor interest in multifamily properties is at an all-time high, the hard-learned lessons of the past several years cannot be ignored. A good location, well-tended units and common areas, and the right amenities are no longer enough to keep occupancy rates up and a property’s value high.

To maximize an asset’s value, the management company must have two main goals:

- meet or exceed budgeted rental income

- meet or exceed budgeted net operating cash flow.

Before this process can begin, owners and investors need to set goals and guidelines for the managers. And that starts with a basic understanding of apartment management dynamics.

What It Takes to Manage Multifamily Properties

The fundamentals of multifamily properties differ greatly from those of commercial properties. For example, in rent control-free markets, apartment leases typically run from six to 12 months, and rents are raised as often and as high as the market will allow. In addition, tenant improvement allowances are virtually nonexistent; “rent-ready” units are leased as is: clean, carpeted, freshly painted, and ready for immediate move in.

Leasing apartments is a relatively simple process, with no intermediaries, no complicated terms, and no negotiations. If one prospect walks away, another most likely won’t.

However, apartment properties comprise large numbers of individual households, and annual turnover is typically 50% to 75% or even higher. As a result, leasing is a continuous process, and providing excellent customer service is critical to securing renewals.

From the manager’s perspective, speed is of the essence: the faster apartments are leased, the higher the property’s cash flow can be. And because prospects often decide to rent a particular apartment for emotional, as well as economic reasons, lease commitments are generally secured relatively quickly.

Measuring Management’s Impact on the Bottom Line

In the vast majority of markets around the country, the appreciation of a specific property’s value depends on the experience and expertise of the management firm responsible for the asset’s day-to-day operations.

There are three major areas of apartment operations that directly affect a property’s economic performance:

- occupancy and rental maximization

- expense management, as it relates to unit turnover

- employee selection and training

To meet each property’s challenges and its owner’s demands, the manager must integrate these disciplines into daily operations. Without proper hiring and training, for example, the management and leasing staff cannot increase the number of new and renewal leases while raising rents and reducing ongoing operating expenses.

Striking the Right Balance Between Rents and Occupancy

From both an investment and an operations standpoint, 95% occupancy is considered the optimum level for multifamily properties. Lenders use the 95% occupancy rate to structure loans, while managers consider 95% to be the balancing point between keeping a property full and focusing on raising rents.

Occupancies must be high and stable to give the manager the ability to command higher rents or even to outperform the market. To get physical occupancy up, however, several things must be in place: curb appeal, a highly trained staff, and an available inventory of “rent-ready” units.

In most situations, prospects will either inadvertently drive by the property, or will be drawn there by an ad or a current resident’s referral. For this reason, curb appeal is vital to draw in prospects.

Properties don’t always have to be freshly painted or brand new, but they must be clean and attractive. This is done by keeping all of the common areas immaculate-from the lawn and leasing office to the sidewalk and swimming pool.

At the leasing office, prospects must find highly trained leasing professionals who can listen and respond to their questions, understand their needs and concerns, and efficiently and skillfully match those needs and concerns to the property’s features.

And, because prospects make rental decisions within a relatively short time period, the property must have an inventory of “rent-ready” apartments to show or, at a minimum, a model.

The other component that properties must have is competitive pricing. Managers can achieve higher-than-average rents by retaining residents who perceive that they are getting higher-than-market value.

How much and how often street rents (the rents quoted to prospects) can be raised is usually a matter of testing. One management company typically raises street rents $5 to $15 per unit every 30 days, depending upon the market and demand for particular floor plans. This continues until the leasing staff acknowledges that closing is difficult; properties with 98% to 100% occupancy suggest higher rents can readily be obtained.

Renewals are typically kept within $10 of the street rate, regardless of how fast rents are rising. This approach gives renewing residents a “preferred customer discount” while being prudent and aggressive about maximizing rental income.

Just three to five years ago, when the apartment supply in many markets exceeded demand, rental rates in these markets just could not be increased. As a result, many owners and managers felt they had maximized rental income by maximizing occupancy, so they focused instead on controlling or even reducing operating expenses.

Although controlling expenses remains a consideration today, many markets have now absorbed their excess supply, and some owners and managers are focusing on obtaining the maximum rent, even if that strategy initially increases resident turnover and operating expenses.

Rent Maximization at Greentree Village

An example of rent maximization is Greentree Village, a 20-year-old apartment property in Colorado Springs with 216 two-bedroom/one-bath units in eight floor plans. The property is exceptionally well located in its marketplace and has very strong curb appeal due to a major renovation in 1991.

As a quality product in a bread-and-butter market, Greentree Village leads its submarket in rents. As of June 1, 1994, Greentree Village’s rents ranged from $515 to $655 per unit, having risen by 17% in 1994, compared to the same period in 1993. This compares with rental growth averages of 7% to 8% in Colorado Springs and 2.4% nationwide in 1993, according to the National Apartment Association.

At Greentree Village, when occupancy hits 98%, management raises rents by $10 to $15 a month, except between the months of November and February. This steady pressure on rents has increased move outs: Greentree averaged about 57% move outs during the first five months of 1994.

Not surprisingly, this property has seen a slight dip in occupancy. Since management consistently raised rents during the first half of 1994, occupancy has remained between 97% and 98%, down from 99% to 100% during the second half of 1993.

Keeping a Lid on Expenses

Reducing operating expenses is crucial to maximizing an apartment property’s value. Through a thorough understanding of apartment operations, leasing, and management, expenses can be tightly controlled.

Some of the larger apartment management companies in the United States have implemented many of the purchasing procedures used by corporate America: in-house purchasing departments that research and negotiate the best terms from suppliers; just-in-time delivery; and immediate use of the purchased item. But there are several basic approaches that any size management company can use to keep property operating costs under control:

- Install and enforce tight checks and balances on all purchases, no matter how small. Every purchase must fit into the property’s approved budget, which specifies the use of all purchases. All capital expenditures and purchases outside budget parameters should require authorization of senior management above the property level.

- Comparison shop for the best prices and vendors, and use just-in-time delivery. By not stockpiling supplies, managers can substantially alleviate potential waste and loss.

- Repair first, and replace only when necessary. Although it is easier and more convenient to replace a broken item for a few dollars, very often the problem can be resolved with parts that cost only a few pennies.

Bearing in mind that each day an apartment sits vacant means from $20 to $40 in unrealized rental income, two important areas of expense management are unit turnover costs and the balanced use of in-house and contract services for “make ready” work.

Because turnover can average 75% per year in a typical apartment property, reducing the number of turnovers is critical, which is why the industry places such a strong emphasis on lease renewals.

A typical, 275-unit property in Phoenix, for example, will turn 192 (or 70%) of its units per year at an average of $580 per turnover (see Table 1). The total cost includes

- lost rent during the vacancy

- advertising and marketing to get prospects through the door (the industry standard is $200 per prospect)

- the leasing agent’s salary and bonus.

Should this property generate $120,000 a month in income, turnover costs would average $100,800 per year, or 7% of total rent. But if management could reduce turnover to 60%, 27 apartments would not have to be leased, saving a minimum of $10,000 each year, although there would still be costs associated with maintenance and leasing personnel.

With fewer vacant apartments to prepare, managers could use maintenance staff more efficiently for non-unit-related projects. Instead of preparing three apartments a month, for example, the staff could paint the trim on two buildings and do the entire property over the course of a year. This would save the $15,000 to $20,000 it would cost to contract the job out on a 275-unit property.

There is an added bonus to reducing the number of turnovers: whereas a property with a high turnover rate requires a full leasing staff and a high level of marketing activity, managers could reduce the number of leasing consultants needed to keep the property full if turnover was significantly lowered.

This careful, balanced use of on-site personnel and contract services, coupled with a sharp eye on expenses, provides a proactive, rather than reactive, approach to the property’s upkeep.

The subsequent rise in the property’s value can be determined by comparing its per-unit expenses to the industry standard of between $1,900 and $2,300, as determined by the Institute of Real Estate Management. For example, the 498-unit Rosehill Pointe Apartments, a nine-year-old complex in the Kansas City area, had expenses of $1,485 per unit at the end of 1993-$815 per unit less than the high end of the industry standard. This equates to annual savings of more than $405,000, and by using a 10% cap rate, results in a more than $4 million increase in value.

Selecting and Training Staff

The selection and training of employees is perhaps the most essential element in multifamily operations, because if this is not done correctly, nothing else will matter. A good management staff is critical, whether they are generating the numbers, sitting behind a desk in the leasing office, sweeping the sidewalk, fixing a faucet, or developing a strategic management plan.

Over the past two years, one property management company has worked closely with an industrial psychologist to develop a profile of top-performing employees. The company uses this profile as a benchmark against which to measure new hires and current employees who may have advancement potential, as well as to determine whether a staff member’s skills would suit one property’s dynamics better than another’s.

The five critical factors that the company has identified as being common to successful employees are:

- reasoning ability

- high energy level

- ability and willingness to take charge

- ability and willingness to take action

- emotional and mental toughness.

This process has been used to successfully fill several critical positions.

Once managers have identified and hired good people, it is essential that they are well trained; unfortunately, there is no training standardin the apartment industry. And, a few years ago when the economics of real estate management became more challenging and profit margins narrowed, many large apartment management companies reduced or eliminated their training departments, and many companies decreased their commitment to training in general.

Others, however, saw the long-term value of training. Many larger companies provide training in three main categories-sales, management/operations, and customer service.

In one firm’s basic customer service training program, employees learn about John and Helen McWaid, a real-life couple who reluctantly left a Dallas-area apartment community after three-and-a-half years to move to a competing property across the street. Their example is important because by losing the McWaids, as typical residents, the management company potentially lost a good portion of hundreds of thousands of dollars in revenue (see Table 2). The McWaids later returned to the property and remain residents to this day.

Achieving a Standard of Excellence

The purpose of intensive employee training, a comprehensive customer service orientation, and a motivated staff is to provide a standard of excellence that remains consistent over time and from property to property.

Managers can see the result of all this effort on the bottom line: during 1993, for example, one nationwide apartment portfolio’s rental income grew by 5.6%, more than twice the national average of 2.3% to 2.4%, as reported by the National Apartment Association.

By applying strategic management techniques, implementing efficient operations procedures, and providing excellent customer service-oriented training to all employees, managers can effectively maximize the value of apartment properties to meet owners’ specific objectives.

________________

If you are looking for an Apartment Broker in southern California, contact Michael Duhs, Managing Broker of East West Commercial.com at (949) 939-8352

www.LosAngelesApartmentsForSale.com

www.OrangeCountyApartmentsForSale.com

www.SanDiegoApartmentsForSale.com

www.RiversideApartmentsForSale.com

www.SanBernardinoApartmentsForSale.com

Export Advantage

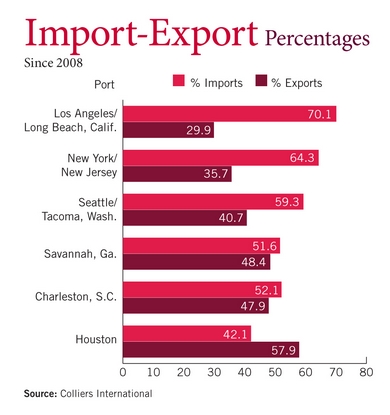

The decline in global trade hit the nation’s industrial markets hard, but not equally hard, according to a Colliers International report. During the global slowdown of the past two years, vacancy rates in port city industrial markets climbed faster than in the overall industrial market. This points up the clear correlation between trade and industrial demand. For every 1 percent change in port TEUs, the standard measure of shipping trade, industrial demand changes 0.33 percent. So the recent 15 percent decrease in TEUs resulted in a 5 percent decline in port city industrial occupancy. But not all port cities experienced the decline equally. In fact, those focusing on exports fared better than those concentrating on imports, as exports to foreign countries remained fairly stable throughout the recession.

Increased import and export business as we come of the recession will benefit Long Beach and Los Angeles County, but also the Inland Empire where most of the goods are warehoused. This is good news for commercial property owners in Los Angeles and San Bernardino. Los Angeles Apartments for Sale, Orange County Apartments for Sale, and San Bernardino Apartments for Sale will benefit.

Michael Duhs, Managing Broker

East West Commercial

(949) 939-8352

Michael.Duhs@EastWestCommercial.com

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook