Commercial Broker Price Opinion

The US industrial market has been helped out by improvements in manufacturing, capital goods shipments, and business and consumer spending. Overall vacancy is declining in the sector and a recovery is underway for many cities. As a result, the portion of US industrial stock in recovery is expected to surge over the next 15 months.

The barometer shows that the best-performing sector in the industry is the US multifamily market, which is dominated by the recovery phase of the real estate cycle and is segueing more and more into the expansion phase annually through 2014. In fact, not one of the 81 multifamily metro areas included in the barometer will be in recession over the next four years.

Information about subscribing to the PwC Real Estate Investor Survey can be found at www.pwc.com/us/realestatesurvey. Members of the media can obtain an electronic copy of the full report by contacting Scott Cianciulli at (212) 986-6667 or cianciulli@braincomm.com.

About the PwC Real Estate Investor SurveyTM

The PwC Real Estate Investor Survey, now in its 24th year of publication, is one of the industry’s longest continuously produced quarterly surveys. The current report provides overviews of 31 separate markets, including ten national markets — regional mall, power center, strip shopping center, CBD office, suburban office, flex/R&D, warehouse, apartment, net lease, and medical office buildings. The report also includes a review of 18 major US office markets including Atlanta, Boston, Charlotte, Chicago, Dallas, Denver, Houston, Los Angeles, Manhattan, Northern Virginia, Pacific Northwest, Philadelphia, Phoenix, San Diego, San Francisco, Southeast Florida, Suburban Maryland, and Washington, DC. In addition, the report covers three regional apartment markets – – Mid-Atlantic, Pacific, and Southeast.

The second quarter 2011 report also features up-to-date information relating to forecast periods, structural vacancy replacement reserves, forecast values, tenant improvement allowances, and vacancy assumptions. In addition, each issue of the Survey contains over ten tables of market data focusing on value expectations, tenant improvement allowances, forecast periods, structural vacancy, and growth rates. Also in this issue is the semiannual National Development Land Market.

About the PwC Network

PwC firms provide industry-focused assurance, tax and advisory services to enhance value for their clients. More than 161,000 people in 154 countries in firms across the PwC network share their thinking, experience and solutions to develop fresh perspectives and practical advice. See www.pwc.com for more information.

© 2011 PwC. All rights reserved. “PwC” and “PwC US” refer to PricewaterhouseCoopers LLP, a Delaware limited liability partnership, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity. This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Scott Cianciulli / Ray Yeung

Brainerd Communicators

Tel: +1 (212) 986 6667

cianciulli@braincomm.com

yeung@braincomm.com

This article comes from Hotel News Resource

http://www.hotelnewsresource.com

The URL for this story is:

http://www.hotelnewsresource.com/article55931.html

Apartment and Commercial Real Estate Investors in San Diego demand will outstrip the supply of marketed apartment and commercial real estate properties this year. Class C assets in these areas will steady in the mid-7 percent range and demand for top-tier apartment properties to the mid-6 percent range.

2011 Market Outlook

· 2011 NAI Rank: 6, Down 4 Places. San Diego will retain a top 10 ranking in the NAI.

· Employment Forecast: A 1.9% increase.

· Vacancy Forecast: 3.6%

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Orange County apartment investment sales will outpace other major California markets for the second consecutive year, fueling considerable occupancy gains as completions slip to historic lows.

2011 Market Outlook

· 2011 NAI Rank: 5, Up 2 Places: Orange County claimed the highest position among Southern California apartment markets due to healthy employment projections and very low home affordability.

· Employment Forecast: In 2011, a 2.6% gain.

· Vacancy Forecast: 4.4% in line with the 10-year average.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Los Angeles County apartment market will gain traction as rehiring efforts boost rental household formation and completions. Los Angeles Apartment Sales will pick up.

Cap rates were pushed down for Class A and well-located Class B product to 6-percent range. Cap rates for assets with some level of distress and located in perimeter areas will average above 7 percent in the early part of 2011.

2011 Market Outlook

· 2011 NAI Rank: 11, Up 2 Places. Los Angeles into the top 10 apartment market.

· Employment Forecast: 1.5% gain.

· Vacancy Forecast: 4.4 % this year.

· Rent Forecast: Rents will advance 2.7%.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Inland Empire apartment operations will strengthen in 2011 as payroll expansion resumes and the pace of new construction remains constrained. Job gains will become a primary driver of renter demand growth. Total employment will post net gains for the first time since 2006, and occupancies will continue to rise, led by strong absorption.

Apartment Investment activity in the region will continue to improve in 2011 as long-term hold buyers purchase bank-owned assets. Opportunities to acquire REO listings and value-add properties will remain prevalent. Cap rates for these assets will average in the mid-7 percent to low-8 percent range this year. Demand for assets closer to Los Angeles County employment centers will outstrip supply.

2011 Market Outlook

· 2011 National Rank: 32, Up 5 Places. Inland Empire kept the market in the bottom 1/3 of the ranking.

· Employment Forecast: Total employment in the two-county region will expand by 1.5%.

· Vacancy Forecast: Average vacancy rate will fall approximately 100 basis points this year to 7%.

· Rent Forecast: Effective rents will increase 2.2%.

· Investment Forecast: Although REO and top-tier deals will dominate sales this year, some unique opportunities will emerge.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

With the potential for higher taxes in 2011 property owners and investors are testing the water to see if they can get their price on selling their properties. As such, Michael Duhs of Commercial Broker Price Opinion BPO / BOV is seeing an acceleration of the number of properties it’s valuating. Commercial Broker Price Opinion BOV / BPO is still seeing an abundant of activity in California, Arizona, Nevada and Florida. For a quote on nationwide Commercial Broker Price Opinion BPO / BPO, call 949-939-8352 or visit http://www.CommercialBrokerPriceOpinion.com

http://www.Commercial-BPO.com

http://www.Commercial-BOV.com

SPOTLIGHT — Los Angeles County, California

Reported by HUD US Market Housing Conditions 2nd Quarter 2010

Los Angeles County, located on the Pacific coast in southern California, has been the most populous county in the nation for more than 50 years, with a population estimated at more than 10 million as of July 1, 2010. The population of Los Angeles County grew by 68,800, or 0.7 percent, during the 12-month period ending June 2010. Population growth improved to 0.4 percent in 2008 and 0.7 percent in 2009 after declining 0.5 percent in both 2004 and 2005. Net natural change (resident births minus resident deaths) accounted for all of the population increase during the 12 months ending June 2010. Since 2006, net out-migration has averaged 50,700 people annually compared with an average net out-migration exceeding 115,000 people a year during the peak years of 2004 and 2005.

Following employment gains averaging about 48,900 jobs in 2006 and 2007, nonfarm employment in Los Angeles County started to decline in 2008. Since 2008, all sectors, except for the education and health services sector, have lost jobs. During the 12-month period end¬ing May 2010, nonfarm employment declined by 200,500 jobs, or 5 percent, to 45.3 million jobs. The largest job losses occurred in the professional and business services, manufacturing, trade, and construction sectors, which were down by 43,700, 40,700, 37,500, and 26,800 jobs, respectively. These losses represented declines of 7, 10, 6, and 20 percent, respectively. Offsetting some of these losses was a modest gain of 8,300 jobs, or 2 percent, in the education and health services sector, which includes Kaiser, the leading private-sector employer in the county, with 34,400 employees. Other leading employers include Northrop Grumman Corporation and The Boeing Company, with 19,100 and 14,400 employees, respectively. During the 12-month period ending May 2010, the average unemployment rate of 12.2 per¬cent was up from the 9.4-percent rate recorded during the previous 12-month period.

High levels of unemployment and out-migration have kept sales housing market conditions soft since 2008. Declining sales prices, low mortgage interest rates, fore¬closure and short sales, and the federal homebuyer tax credit caused a temporary rise in existing home sales. According to DataQuick, during the 12 months ending March 2010 (the most recent data available), a total of 59,100 existing detached homes were sold, up 9,450, or 19 percent, compared with the number of homes sold during the previous 12-month period. Although home sales levels are improving, current levels are still significantly lower than the peak of 100,200 existing detached homes sold in 2004 and are less than the average annual rate of 64,850 homes sold from 2005 to 2009.

During the 12-month period ending March 2010, the estimated median price for an existing detached home declined by $43,700, or 12 percent, to $322,900 compared with the price recorded during the previous 12 months. Sales of foreclosed homes and short sales are the primary reason for the price declines.

According to Lender Processing Services Mortgage Performance Data, the number of loans that are in foreclosure, 90 days or more delinquent, or in REO (Real Estate Owned) accounted for 10.4 percent of all home loans in June 2010 compared with 9.4 percent in June 2009.

Condominiums represent more than 60 percent of new home sales and 23 percent of existing home sales in Los Angeles County. Except for North Los Angeles County, new homes are generally built on infill land, making condominiums more financially feasible to build than single-family homes. According to Hanley Wood, LLC, new condominium home sales increased by 1,150, or 54 percent, to 3,300 homes during the 12 months end¬ing March 2010, when buyers tried to beat the federal tax credit deadline. For the 12 months ending March 2010, the estimated median price for a new condominium was $437,100, up $2,100, or 0.5 percent, from the previous 12-month period. The unsold inventory of new condominiums declined 19 percent between the first quarter of 2009 and the first quarter of 2010. According to DataQuick, existing condominium sales also increased during the 12-month period ending March 2010, up by 3,850 homes, or 28 percent, to 17,900 homes sold compared with the number sold during the 12 months ending March 2009. The estimated median sales price of existing condominiums was $302,000, a decline of $34,400 compared with the price during the 12 months ending March 2009, due to foreclosure sales.

In contrast with the increased sales of existing detached homes and new and existing condominiums, sales of new detached homes have declined. According to Hanley Wood, LLC, during the 12 months ending March 2010, new detached home sales declined by 360 homes, to 730 homes, a 33-percent decrease compared with the number sold during the previous 12 months. The current total is significantly below the peak of 6,000 new detached homes sold in 2005 and below the average annual rate of 2,850 homes sold between 2005 and 2009. During the 12 months ending March 2010, the estimated median price for a new detached home increased by $18,450, or 5 percent, to $416,400 compared with the price during the previous 12-month period. The price increase was the result of more homes being sold in the San Fernando Valley than in North Los Angeles County.

Builders reduced single-family home construction activity because of competition from foreclosures and the continued loss of jobs in the county. Single-family construction activity, as measured by the number of building permits issued, peaked in 2005, when more than 12,200 single-family permits were issued. Preliminary data indicate that, during the 12 months ending May 2010, about 2,250 single-family homes were permitted, a decline of 5 percent compared with the number permitted during the previous 12 months.

The Los Angeles County rental market has been balanced since the fourth quarter of 2008 because it has benefited from increased demand and a lower rate of multifamily construction. Based on data from Reis, Inc., between the first quarter of 2009 and the first quarter of 2010, the rental vacancy rate increased slightly, from 5.3 to 5.5 per¬cent. According to Reis, Inc., in the first quarter of 2010, average effective rents declined $50 to $1,350 compared with rents during the first quarter of 2009.

Multifamily construction activity, as measured by the number of units permitted, declined during the 12 months ending May 2010 compared with the number permitted during the previous 12-month period, based on preliminary data. The number of multifamily units permitted was 3,500, down 1,900 units, or 35 percent, compared with the number permitted during the previous 12 months and was significantly lower than the average annual rate of 10,200 units permitted between 2005 and 2009. Currently, 84 percent of the multifamily units permitted are for rental units, up from 52 percent in 2006. The 375-unit 1600 Vine Apartments in Hollywood opened in November 2009, with move-in special rents ranging from $1,794 for a studio to $11,125 for a three-bedroom townhome.

____________________________________________________

For professional expertise with Los Angeles, San Diego, Orange County, Riverside, and San Bernardino — commercial real estate, apartments for sale, investment property, commercial REO’s, commercial BOV’s, commercial broker price opinion BPO’s, or asset management, please contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or (949) 939-8352. Visit us at http://www.EastWestCommercial.com.

As Reported by Trepp

Defaults on commercial real estate loans are beginning to play a larger role in the failure of FDIC-insured institutions than construction loans, according to Trepp LLC.

Six banks closed by the government on Friday – three of which were in Georgia — had $152 million of nonperforming loans, 44% of which were CRE mortgages. Roughly 37% of the NPLs were construction loans.

“We have seen a shift over the last several quarters with commercial mortgages contributing to a larger portion of the distress” said Matt Anderson of Foresight Analytics and a resident CRE expert at Trepp.

The failure of the six banks brings the total for this year up to 125. Last year the Federal Deposit Insurance Corp. closed 140 bank institutions.

As of June 30, banks and thrifts held $1.01 trillion of CRE loans (not including multifamily loans) on their books with 4.28% considered seriously delinquent, up from 2.89% a year ago, according to FDIC figures.

Banks also held $383 billion of construction and development loans with 16.9 % considered seriously delinquent (90-days or more past due), compared to 13.5% a year ago.

Meanwhile, FDIC has 829 banks with $403 billion in assets on its “problem” list.

_________________________________

For professional expertise with Los Angeles, San Diego, Orange County, Riverside, and San Bernardino — commercial real estate, investment property, commercial REO’s, commercial BOV’s, commercial broker price opinion BPO’s, or asset management, please contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or (949) 939-8352. Visit us at http://www.EastWestCommercial.com.

Decreased Office Rents Spur Orange County Market

According to the OC Register article dated August 15, 2010,“Rent Cuts Inject Life into Market”, Erika Chavez reports that the Orange County commercial real estate market has been hit hard especially for the first two quarters of 2010. Office vacancy rates have increased from 18.2% from the 1st quarter to 18.4% in the 2nd quarter.

Businesses aggressively signed leases for a reported additional 200,000 square feet causing these elevated vacancy rates for the 2nd quarter. Last year, the average asking rent was estimated at $2.30 per square foot whereas today, it falls right at $2.06 per square foot. Despite the heavy economical blow, the Orange County rental market has seen a glimpse of hope on the horizon.

Landlords are now offering extensive cuts on rent just to entice a steady stream of customers. Businesses are taking advantage of these rent cuts and seeing the potential opportunity for growth and expansion while it is still affordable.

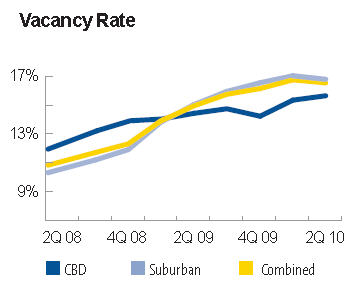

Office Vacancy Rates Remain High Nationwide

Even though renters are eager, the nationwide vacancy rate rose 3.4 percentage points in the last year. Orange County is 4th in the category of most aggressive rent cuts. Leading the nation in rent cuts for the year is Phoenix up 4.2 percentage points, Palm Beach, FL, up 4 percentage points, and Fairfield, Conn, up 3.5 percentage points. Reports have stated that in Orange County office rents have fallen by 1.5% between the 1st and 2nd quarters of this year. These OC cuts are the most drastic by big landlords amongst the 82 nationwide markets surveyed. After 2nd quarter reports came in, Orange County had 20.7% of vacant office space.

On a nationwide scale, these astronomical vacancies have risen for a 10th consecutive quarter which has not been seen by our country for over 17 years. It is going to take a while to see any changes in this bleak market. Landlords are hoping to entice renters with discounted rent rates; however, it will take a lot more than discounted rate to turn the Orange County commercial market around.

__________________________________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook