Lenders

Orange County apartment investment sales will outpace other major California markets for the second consecutive year, fueling considerable occupancy gains as completions slip to historic lows.

2011 Market Outlook

· 2011 NAI Rank: 5, Up 2 Places: Orange County claimed the highest position among Southern California apartment markets due to healthy employment projections and very low home affordability.

· Employment Forecast: In 2011, a 2.6% gain.

· Vacancy Forecast: 4.4% in line with the 10-year average.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Los Angeles County apartment market will gain traction as rehiring efforts boost rental household formation and completions. Los Angeles Apartment Sales will pick up.

Cap rates were pushed down for Class A and well-located Class B product to 6-percent range. Cap rates for assets with some level of distress and located in perimeter areas will average above 7 percent in the early part of 2011.

2011 Market Outlook

· 2011 NAI Rank: 11, Up 2 Places. Los Angeles into the top 10 apartment market.

· Employment Forecast: 1.5% gain.

· Vacancy Forecast: 4.4 % this year.

· Rent Forecast: Rents will advance 2.7%.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Inland Empire apartment operations will strengthen in 2011 as payroll expansion resumes and the pace of new construction remains constrained. Job gains will become a primary driver of renter demand growth. Total employment will post net gains for the first time since 2006, and occupancies will continue to rise, led by strong absorption.

Apartment Investment activity in the region will continue to improve in 2011 as long-term hold buyers purchase bank-owned assets. Opportunities to acquire REO listings and value-add properties will remain prevalent. Cap rates for these assets will average in the mid-7 percent to low-8 percent range this year. Demand for assets closer to Los Angeles County employment centers will outstrip supply.

2011 Market Outlook

· 2011 National Rank: 32, Up 5 Places. Inland Empire kept the market in the bottom 1/3 of the ranking.

· Employment Forecast: Total employment in the two-county region will expand by 1.5%.

· Vacancy Forecast: Average vacancy rate will fall approximately 100 basis points this year to 7%.

· Rent Forecast: Effective rents will increase 2.2%.

· Investment Forecast: Although REO and top-tier deals will dominate sales this year, some unique opportunities will emerge.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Decreased Office Rents Spur Orange County Market

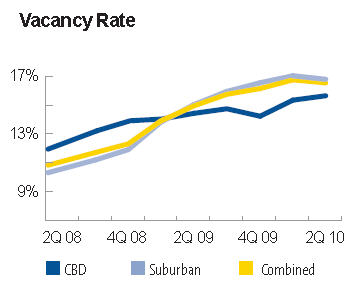

According to the OC Register article dated August 15, 2010,“Rent Cuts Inject Life into Market”, Erika Chavez reports that the Orange County commercial real estate market has been hit hard especially for the first two quarters of 2010. Office vacancy rates have increased from 18.2% from the 1st quarter to 18.4% in the 2nd quarter.

Businesses aggressively signed leases for a reported additional 200,000 square feet causing these elevated vacancy rates for the 2nd quarter. Last year, the average asking rent was estimated at $2.30 per square foot whereas today, it falls right at $2.06 per square foot. Despite the heavy economical blow, the Orange County rental market has seen a glimpse of hope on the horizon.

Landlords are now offering extensive cuts on rent just to entice a steady stream of customers. Businesses are taking advantage of these rent cuts and seeing the potential opportunity for growth and expansion while it is still affordable.

Office Vacancy Rates Remain High Nationwide

Even though renters are eager, the nationwide vacancy rate rose 3.4 percentage points in the last year. Orange County is 4th in the category of most aggressive rent cuts. Leading the nation in rent cuts for the year is Phoenix up 4.2 percentage points, Palm Beach, FL, up 4 percentage points, and Fairfield, Conn, up 3.5 percentage points. Reports have stated that in Orange County office rents have fallen by 1.5% between the 1st and 2nd quarters of this year. These OC cuts are the most drastic by big landlords amongst the 82 nationwide markets surveyed. After 2nd quarter reports came in, Orange County had 20.7% of vacant office space.

On a nationwide scale, these astronomical vacancies have risen for a 10th consecutive quarter which has not been seen by our country for over 17 years. It is going to take a while to see any changes in this bleak market. Landlords are hoping to entice renters with discounted rent rates; however, it will take a lot more than discounted rate to turn the Orange County commercial market around.

__________________________________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Bank Closures Top 100

Bank closures topped 100 nationwide to date, already exceeding last year’s calendar year. At this time last year, regulators closed 64 banks due to the recession and loans defaulting. The year 2009 had 140 bank closures. This year, however, a total of 101 bank closures have occurred so far.

This year, the U.S. will definitely see numbers far larger.

Forecasted Outlook for 2010

If this year’s bank closure pace continues the number of bank closures expected for 2010 is estimated at 200 or more, which is a 43% increase over last year’s closure.

_________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook