Commercial Real Estate Financing

Orange County apartment investment sales will outpace other major California markets for the second consecutive year, fueling considerable occupancy gains as completions slip to historic lows.

2011 Market Outlook

· 2011 NAI Rank: 5, Up 2 Places: Orange County claimed the highest position among Southern California apartment markets due to healthy employment projections and very low home affordability.

· Employment Forecast: In 2011, a 2.6% gain.

· Vacancy Forecast: 4.4% in line with the 10-year average.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Los Angeles County apartment market will gain traction as rehiring efforts boost rental household formation and completions. Los Angeles Apartment Sales will pick up.

Cap rates were pushed down for Class A and well-located Class B product to 6-percent range. Cap rates for assets with some level of distress and located in perimeter areas will average above 7 percent in the early part of 2011.

2011 Market Outlook

· 2011 NAI Rank: 11, Up 2 Places. Los Angeles into the top 10 apartment market.

· Employment Forecast: 1.5% gain.

· Vacancy Forecast: 4.4 % this year.

· Rent Forecast: Rents will advance 2.7%.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

Inland Empire apartment operations will strengthen in 2011 as payroll expansion resumes and the pace of new construction remains constrained. Job gains will become a primary driver of renter demand growth. Total employment will post net gains for the first time since 2006, and occupancies will continue to rise, led by strong absorption.

Apartment Investment activity in the region will continue to improve in 2011 as long-term hold buyers purchase bank-owned assets. Opportunities to acquire REO listings and value-add properties will remain prevalent. Cap rates for these assets will average in the mid-7 percent to low-8 percent range this year. Demand for assets closer to Los Angeles County employment centers will outstrip supply.

2011 Market Outlook

· 2011 National Rank: 32, Up 5 Places. Inland Empire kept the market in the bottom 1/3 of the ranking.

· Employment Forecast: Total employment in the two-county region will expand by 1.5%.

· Vacancy Forecast: Average vacancy rate will fall approximately 100 basis points this year to 7%.

· Rent Forecast: Effective rents will increase 2.2%.

· Investment Forecast: Although REO and top-tier deals will dominate sales this year, some unique opportunities will emerge.

For investment sales information with commercial real estate in Los Angeles, San Diego, Orange County, Riverside, San Bernardino — Apartments for Sale, investment property, commercial REO’s, commercial bpo’s, commercial bov’s, and commercial broker price opinions, please contact Michael Duhs, Managing Director of East West Commercial at www.EastWestCommercial.com or (949) 939-8352.

As Reported by Marcus & Millichap in the 2011 Annual Report.

SPOTLIGHT — Los Angeles County, California

Reported by HUD US Market Housing Conditions 2nd Quarter 2010

Los Angeles County, located on the Pacific coast in southern California, has been the most populous county in the nation for more than 50 years, with a population estimated at more than 10 million as of July 1, 2010. The population of Los Angeles County grew by 68,800, or 0.7 percent, during the 12-month period ending June 2010. Population growth improved to 0.4 percent in 2008 and 0.7 percent in 2009 after declining 0.5 percent in both 2004 and 2005. Net natural change (resident births minus resident deaths) accounted for all of the population increase during the 12 months ending June 2010. Since 2006, net out-migration has averaged 50,700 people annually compared with an average net out-migration exceeding 115,000 people a year during the peak years of 2004 and 2005.

Following employment gains averaging about 48,900 jobs in 2006 and 2007, nonfarm employment in Los Angeles County started to decline in 2008. Since 2008, all sectors, except for the education and health services sector, have lost jobs. During the 12-month period end¬ing May 2010, nonfarm employment declined by 200,500 jobs, or 5 percent, to 45.3 million jobs. The largest job losses occurred in the professional and business services, manufacturing, trade, and construction sectors, which were down by 43,700, 40,700, 37,500, and 26,800 jobs, respectively. These losses represented declines of 7, 10, 6, and 20 percent, respectively. Offsetting some of these losses was a modest gain of 8,300 jobs, or 2 percent, in the education and health services sector, which includes Kaiser, the leading private-sector employer in the county, with 34,400 employees. Other leading employers include Northrop Grumman Corporation and The Boeing Company, with 19,100 and 14,400 employees, respectively. During the 12-month period ending May 2010, the average unemployment rate of 12.2 per¬cent was up from the 9.4-percent rate recorded during the previous 12-month period.

High levels of unemployment and out-migration have kept sales housing market conditions soft since 2008. Declining sales prices, low mortgage interest rates, fore¬closure and short sales, and the federal homebuyer tax credit caused a temporary rise in existing home sales. According to DataQuick, during the 12 months ending March 2010 (the most recent data available), a total of 59,100 existing detached homes were sold, up 9,450, or 19 percent, compared with the number of homes sold during the previous 12-month period. Although home sales levels are improving, current levels are still significantly lower than the peak of 100,200 existing detached homes sold in 2004 and are less than the average annual rate of 64,850 homes sold from 2005 to 2009.

During the 12-month period ending March 2010, the estimated median price for an existing detached home declined by $43,700, or 12 percent, to $322,900 compared with the price recorded during the previous 12 months. Sales of foreclosed homes and short sales are the primary reason for the price declines.

According to Lender Processing Services Mortgage Performance Data, the number of loans that are in foreclosure, 90 days or more delinquent, or in REO (Real Estate Owned) accounted for 10.4 percent of all home loans in June 2010 compared with 9.4 percent in June 2009.

Condominiums represent more than 60 percent of new home sales and 23 percent of existing home sales in Los Angeles County. Except for North Los Angeles County, new homes are generally built on infill land, making condominiums more financially feasible to build than single-family homes. According to Hanley Wood, LLC, new condominium home sales increased by 1,150, or 54 percent, to 3,300 homes during the 12 months end¬ing March 2010, when buyers tried to beat the federal tax credit deadline. For the 12 months ending March 2010, the estimated median price for a new condominium was $437,100, up $2,100, or 0.5 percent, from the previous 12-month period. The unsold inventory of new condominiums declined 19 percent between the first quarter of 2009 and the first quarter of 2010. According to DataQuick, existing condominium sales also increased during the 12-month period ending March 2010, up by 3,850 homes, or 28 percent, to 17,900 homes sold compared with the number sold during the 12 months ending March 2009. The estimated median sales price of existing condominiums was $302,000, a decline of $34,400 compared with the price during the 12 months ending March 2009, due to foreclosure sales.

In contrast with the increased sales of existing detached homes and new and existing condominiums, sales of new detached homes have declined. According to Hanley Wood, LLC, during the 12 months ending March 2010, new detached home sales declined by 360 homes, to 730 homes, a 33-percent decrease compared with the number sold during the previous 12 months. The current total is significantly below the peak of 6,000 new detached homes sold in 2005 and below the average annual rate of 2,850 homes sold between 2005 and 2009. During the 12 months ending March 2010, the estimated median price for a new detached home increased by $18,450, or 5 percent, to $416,400 compared with the price during the previous 12-month period. The price increase was the result of more homes being sold in the San Fernando Valley than in North Los Angeles County.

Builders reduced single-family home construction activity because of competition from foreclosures and the continued loss of jobs in the county. Single-family construction activity, as measured by the number of building permits issued, peaked in 2005, when more than 12,200 single-family permits were issued. Preliminary data indicate that, during the 12 months ending May 2010, about 2,250 single-family homes were permitted, a decline of 5 percent compared with the number permitted during the previous 12 months.

The Los Angeles County rental market has been balanced since the fourth quarter of 2008 because it has benefited from increased demand and a lower rate of multifamily construction. Based on data from Reis, Inc., between the first quarter of 2009 and the first quarter of 2010, the rental vacancy rate increased slightly, from 5.3 to 5.5 per¬cent. According to Reis, Inc., in the first quarter of 2010, average effective rents declined $50 to $1,350 compared with rents during the first quarter of 2009.

Multifamily construction activity, as measured by the number of units permitted, declined during the 12 months ending May 2010 compared with the number permitted during the previous 12-month period, based on preliminary data. The number of multifamily units permitted was 3,500, down 1,900 units, or 35 percent, compared with the number permitted during the previous 12 months and was significantly lower than the average annual rate of 10,200 units permitted between 2005 and 2009. Currently, 84 percent of the multifamily units permitted are for rental units, up from 52 percent in 2006. The 375-unit 1600 Vine Apartments in Hollywood opened in November 2009, with move-in special rents ranging from $1,794 for a studio to $11,125 for a three-bedroom townhome.

____________________________________________________

For professional expertise with Los Angeles, San Diego, Orange County, Riverside, and San Bernardino — commercial real estate, apartments for sale, investment property, commercial REO’s, commercial BOV’s, commercial broker price opinion BPO’s, or asset management, please contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or (949) 939-8352. Visit us at http://www.EastWestCommercial.com.

As Reported by Trepp

Defaults on commercial real estate loans are beginning to play a larger role in the failure of FDIC-insured institutions than construction loans, according to Trepp LLC.

Six banks closed by the government on Friday – three of which were in Georgia — had $152 million of nonperforming loans, 44% of which were CRE mortgages. Roughly 37% of the NPLs were construction loans.

“We have seen a shift over the last several quarters with commercial mortgages contributing to a larger portion of the distress” said Matt Anderson of Foresight Analytics and a resident CRE expert at Trepp.

The failure of the six banks brings the total for this year up to 125. Last year the Federal Deposit Insurance Corp. closed 140 bank institutions.

As of June 30, banks and thrifts held $1.01 trillion of CRE loans (not including multifamily loans) on their books with 4.28% considered seriously delinquent, up from 2.89% a year ago, according to FDIC figures.

Banks also held $383 billion of construction and development loans with 16.9 % considered seriously delinquent (90-days or more past due), compared to 13.5% a year ago.

Meanwhile, FDIC has 829 banks with $403 billion in assets on its “problem” list.

_________________________________

For professional expertise with Los Angeles, San Diego, Orange County, Riverside, and San Bernardino — commercial real estate, investment property, commercial REO’s, commercial BOV’s, commercial broker price opinion BPO’s, or asset management, please contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or (949) 939-8352. Visit us at http://www.EastWestCommercial.com.

Decreased Office Rents Spur Orange County Market

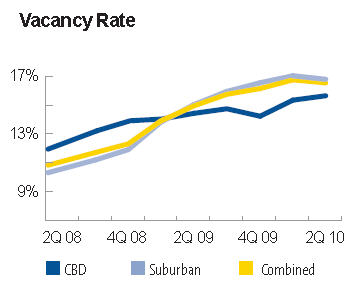

According to the OC Register article dated August 15, 2010,“Rent Cuts Inject Life into Market”, Erika Chavez reports that the Orange County commercial real estate market has been hit hard especially for the first two quarters of 2010. Office vacancy rates have increased from 18.2% from the 1st quarter to 18.4% in the 2nd quarter.

Businesses aggressively signed leases for a reported additional 200,000 square feet causing these elevated vacancy rates for the 2nd quarter. Last year, the average asking rent was estimated at $2.30 per square foot whereas today, it falls right at $2.06 per square foot. Despite the heavy economical blow, the Orange County rental market has seen a glimpse of hope on the horizon.

Landlords are now offering extensive cuts on rent just to entice a steady stream of customers. Businesses are taking advantage of these rent cuts and seeing the potential opportunity for growth and expansion while it is still affordable.

Office Vacancy Rates Remain High Nationwide

Even though renters are eager, the nationwide vacancy rate rose 3.4 percentage points in the last year. Orange County is 4th in the category of most aggressive rent cuts. Leading the nation in rent cuts for the year is Phoenix up 4.2 percentage points, Palm Beach, FL, up 4 percentage points, and Fairfield, Conn, up 3.5 percentage points. Reports have stated that in Orange County office rents have fallen by 1.5% between the 1st and 2nd quarters of this year. These OC cuts are the most drastic by big landlords amongst the 82 nationwide markets surveyed. After 2nd quarter reports came in, Orange County had 20.7% of vacant office space.

On a nationwide scale, these astronomical vacancies have risen for a 10th consecutive quarter which has not been seen by our country for over 17 years. It is going to take a while to see any changes in this bleak market. Landlords are hoping to entice renters with discounted rent rates; however, it will take a lot more than discounted rate to turn the Orange County commercial market around.

__________________________________________________________

For assistance with Commercial Real Estate — investment sales, asset management, commercial REO, commercial BOV’s, commercial broker price opinion. Contact Michael Duhs, Managing Director of East West Commercial at Michael.Duhs@EastWestCommercial.com or http://www.EastWestCommercial.com or (949) 939-8352.

Interested Investors Should Understand the Critical Components of These Lease Structures.

By Letty M. Bierschenk, CCIM, Kurt R. Bierschenk, CCIM, and William C. Bierschenk, CCIM

Many real estate investors think nothing could be simpler than an investment in a triple-net-leased (also known as NNN) property. Some liken it to buying a bond. While straightforward to own and operate, triple-net-leased properties can be the most challenging type of real estate investment for advisers to structure or — if the lease already exists — to understand. With lease terms as long as 50 or more years when options are taken into account, due diligence is critical, as changes usually cannot be made later on.

To prevent costly mistakes during the lease term, investment advisers must completely master all critical components of the transaction early in the negotiations. These include the client’s objectives for the investment, the lease document, the type of tenant, the physical real estate, and the type of seller.

The Client’s Objective

Investors considering triple-net-leased properties usually have certain objectives in mind that might not be met by typical real estate investments. These may include relief from management obligations, assured income, pride of ownership, and preservation of capital.

Many investors seek a suitable replacement property to complete a tax-deferred exchange. Having sold a management-intensive property such as a multifamily building, they must reinvest in real estate to take advantage of the exchange provisions. They still need the income, but they no longer want a landlord’s responsibilities. In addition, many take pride in having a well-known and respected company as a tenant. Others are most interested in providing an estate for their heirs, and they prefer to have less current income with the highest possible tax deductions from interest and depreciation.

Although all of these objectives can be met through triple-net-leased investments, the variations in different triple-net-leased properties need to be considered as well.

A Lease Primer

Unlike typical commercial real estate transactions, approach the analysis of a triple-net-leased investment with the idea that it is the lease, rather than the building and land, that the investor is purchasing.

Because definitions of triple-net leases differ, be certain that you understand your client’s concept of what the lease should and should not include. You may discover that a triple-net lease does not meet the client’s objectives after all. Also, be aware that the term is widely misused in brokers’ marketing materials.

After finding a potential property, obtain a copy of the lease and analyze it first. Otherwise you can waste time and money on market studies, inspections, and contract negotiations only to find during due diligence that one paragraph in the lease knocks the property out of consideration.

Generally a net lease refers to the arrangement where the tenant pays all or some of a property’s operating costs in addition to rent. Several general gradations of net leases have evolved over the years. These are summarized here, ranked from strongest to weakest, beginning with the lease that gives the tenant absolute responsibility for the real estate in exchange for absolute control.

Bond Lease. The tenant is fully responsible for operating expenses, maintenance, repairs, and replacements for the entire building and site, without limitation.

NNN Lease. These leases follow the bond lease definition except that capital expenditures are limited, usually in the final months of the lease. The lessee is liable for all of the property’s expenses, both fixed and operating.

NN Lease. This lease follows the NNN, except the landlord is responsible for structural components, such as the roof, bearing walls, and foundation.

Modified Net (or Modified Gross) Lease. The tenant pays its own utilities, interior maintenance and repairs, and insurance. The landlord pays everything else, including real estate property taxes.

Regardless of the type of net lease, many fluctuations, such as increasing utility costs and changes in government regulations, cause problems under rigid lease terms over time. Investors must be aware of lease nuances that may seem innocuous but require knowledge and planning in order to avoid future disappointments or disasters. Two such examples are the inflation trap and the taxation burden.

The Inflation Trap. At one time, single-tenant leases were structured with flat income for 25 or 30 years, and then had a series of options at drastically reduced rent, such as 2 percent of the property’s value. The theory was that the loan would be paid off by then, so the landlord’s spendable income would not be reduced. But inflation made this a nightmare for owners. When income was compared to current rent schedules, properties only could be sold at tremendous price reductions.

Today new leases take this possibility into account by specifying periodic rent increases, with options, if any, pegged to “fair market rent” or other indicators that preserve the income level.

Taxation Burden. Local laws and customs also may affect leases. For example, because triple-net tenants are responsible for real estate taxes, including any future increases, a unique situation developed in California with “Proposition 13″ in 1978. It established a new base tax amount of 1 percent of the then value and limited tax increases to 2 percent each year until the property sold. Upon sale, taxes would be recalculated to 1 percent of the new purchase price. This formula, combined with soaring real estate values, meant that tenants were faced with wild leaps in rental rates due solely to changes of ownership, which in no way benefited the tenant.

Today tenants and landlords still are hamstrung over this issue. Tenants generally agree to an allowance for pass-throughs of increases except in the event of a sale. Owners reject these lease provisions, correctly noting that the impact on the net income to a future buyer results in a reduced market value of the real estate.

Triple-Net Tenants

After mastering the lease, the next factor to evaluate is the tenant.

Credit Worthiness. From an investor’s perspective, a triple-net-leased property’s price should reflect the tenant’s ability to meet the terms of the lease. The capitalization rate indicates this variable risk factor, because it directly represents the relationship of the stipulated net income to the price a knowledgeable investor is willing to pay. The higher the risk that a tenant may not be solvent over the long term, the higher the cap rate should be.

A tremendous amount of information is available to assist in evaluating the current and future financial strength of a tenant. If it is a public company, the credit rating is fairly easy to determine through a number of sources, including sites available on the Internet such as http://www.companysleuth.com/, http://www.zacks.com/, and http://www.freeedgar.com/.

The trend toward mergers and divestments adds another dimension to credit reviews. Even though the resulting entity usually is stronger than the original company, the risk of the unknown can be perceived as a negative factor.

If the business is complex or privately held, contact a fee-based tenant underwriting service for added assistance.

Type of Use. Even if the credit rating is substantial, the type of business may affect investment value. From an investment standpoint, a general-purpose use, where tenant improvements easily are convertible to another tenant’s needs, is more desirable than a special-use project. In many special-use cases, the seller passes along the costs of highly specialized improvements to the buyer, who may be unable to recover that portion of the investment over the lease term. Fast-food outlets are a prime example of this problem, but certainly not the only one.

The Physical Real Estate

After reviewing the lease and tenant/landlord compatibility, investors then should evaluate the physical real estate. All categories of office, industrial, retail, multifamily, and hotel properties, and even undeveloped land, can be sold on a triple-net-lease basis, without regard for size, design, or location. However, retail, office, and industrial most often are available in the marketplace.

Businesses that typically lease rather than own their real estate are those that achieve a business-income yield that is substantially higher than the typical real estate yield of 8 percent to 10 percent pre-tax. High-volume retail operations are probably most prevalent. But each investment must be considered individually. For instance, if an investor purchases a special-purpose building with a “theme” construction, the net worth of the company is of prime importance. On the other hand, a food market in a good neighborhood shopping center most likely can withstand even a change of tenancy without significant loss of income.

Similarly, industrial buildings can be classified as warehouse, manufacturing, or research and development space. They come with and without substantial office space and range in size from 10,000 square feet to 500,000 sf. Even warehouse space can be highly specialized today, including high-cube to accommodate the new storage technology, or dock-high local storage for lower volume distribution.

Manufacturing facilities usually have the greatest number of special-purpose characteristics, such as drainage wells, overhead cranes, two-foot-thick concrete floors, and special lighting and exhaust systems that preclude their use by other businesses. The possibility of hazardous materials in any manufacturing process may require consultation with experts who can advise on ways to minimize the landlord’s liability for adverse consequences.

Office buildings, even though they come in all sizes and styles — from free-standing, one-room buildings to lush garden complexes to high-rise palatial headquarters — are easiest to evaluate because they are the most closely tied to location as an indicator.

The purchase price should take into account replacement costs and comparable sales, but be wary of an overmarket rent that cannot be achieved with another tenant in the future. Inflated rents may make the investment return appear desirable. However, if market rents and prices of comparable buildings in the area are substantially lower, the resale value may be less than what the investor paid for the property and the actual yield probably will be lower than other alternative opportunities in the marketplace.

Analyze the effect of overmarket rents on investments by generating a range of internal rate of return calculations, incorporating these assumptions that might impact resale values:

- The tenant renews at a consistent rental rate in the year of sale.

- The property must be released at projected market rent in the year of sale for the same type of use.

- The property must be released for a different use.

Comparing these IRRs demonstrates the marginal value attributed to the current tenant, over and above the demonstrated investment value. Whether or not it is in line with reality can be a subjective call based largely on a client’s “feel” for the company. Quite often, buyers will ignore the importance of the type and location of the real estate when evaluating a triple-net investment. It is not unusual for a fast-food facility to sell at four or five times the replacement value, because the investor is satisfied with the projected return based on the tenant’s strength and length of the lease. But brokers must educate buyers as to the potential problems if such tenants were to go out of business.

Furthermore, if the triple-net facility is located in a shopping center, the owner also must consider the effect of a possible failure of the business location, even if the tenant “goes dark” but continues to pay rent. The loss of traffic, which the credit tenant might have drawn, can impact the sales volumes of every other tenant in the center and destroy the synergism of a previously well-constructed retail mix.

Triple-Net Sellers

Triple-net-leased property sellers fall into three categories: investor/owners of leased properties; owner/users creating sale/leasebacks; and build-to-suit developers.

Investor/Owner. This type of seller presents a known entity for an investor’s analysis. The lease may be a true triple net but with a short remaining primary lease term, requiring either re-leasing or a series of short-term options. Investors can evaluate base rent and expense payment history and may have access to historical sales volumes to assist in determining the likelihood of future income.

Even after the prospective purchaser has analyzed and approved the lease, stipulate a review of an estoppel as a contingency of closing. Many sellers only are willing to involve a tenant during the final stages of the transaction, when they are assured of a sale. However consider what may happen if the estoppel comes back a week before closing and it differs in some way from what the seller’s documents had shown, or worse yet, presents an addendum granting a first right of refusal to purchase the property. Have a clear understanding as to when the seller is willing to submit the form, take note of the response time agreed to by the tenant in the lease, and build this into your contingency timeline.

Owner/User. The triple-net lease is well suited to sale/leasebacks as a way to transition the selling company from having absolute control over its surroundings to a situation where it merely is a “lessee.” Despite the emotional response that may be generated by the change in status, the sale/leaseback provides a number of advantages to both seller and buyer. The seller frees up capital, often 100 percent of the equity in the real estate, to expand or enhance the business. Since a business return, generally speaking, is higher than the typical 8 percent to 10 percent real estate return, the seller can benefit from the lower cost of investment capital.

Sellers and buyers also benefit by being able to customize a transaction, negotiating sale and lease terms that reflect unique landlord and tenant needs. Investors, for example, may agree to a higher purchase price in exchange for stipulated rent increases, rather than taking the risk of cost-of-living increases. They may trade a short initial term for a series of 10-year rather than five-year options. Tenants may feel comfortable with the obligations of a bond-type lease because they know the property.

One potential negative is the possibility that the seller overimproved the physical plant to enhance the company’s image and expects the buyer to cover overmarket amenities. This occurs most often with office buildings, but overimproved industrial facilities can be even more difficult to evaluate since the perception of overimprovement is related to the location as well as to the building itself.

Developer. From a logistics standpoint, developers are relatively straightforward, since they are professionals who will have the information you need readily available. As always, consider the seller’s motivations. The developer’s first objective is to build. With a lease in hand, the developer can get construction financing and create the product. The second objective is to sell at a profit, so it is necessary to build a return into the transaction. However, the developer’s costs may be relatively low because of economies of scale in creating a large amount of product. One of the benefits is that the lease is already drawn, and a meticulous analysis of the terms virtually can eliminate the chance of contractual surprises during your client’s ownership.

The main potential downside is that there is no performance history for the site. Second, even experienced developers sometimes give in to a strong tenant’s demands, even though the terms may be detrimental to the property’s investment value.

Armchair Investments

Carefully structured and underwritten, a triple-net-leased real estate investment can be an armchair type of investment. However, before an investor commits capital to such a long-term investment vehicle, pre-acquisition due diligence is paramount. Real estate advisers must ascertain the degree to which the lease is, in fact, a triple-net, the likelihood that the tenant will succeed, and the suitability of the real estate itself for the proposed and subsequent use. Finally, match all of these components to the unique characteristics and goals of the investor to determine if this type of property is a right fit.

Twitter

Twitter

LinkedIn

LinkedIn

YouTube

YouTube

Facebook

Facebook